Drink labs is a curated team of beverage scientists, graphic designers, and operations specialists working together to bring your beverage ideas to life. Our expert team creates formulas that are unique to market; helping you create a viable brand from the ground up.

The Importance of Beverage Ingredient Sourcing

Entrepreneurship is alive and well and so is the multi-million dollar food and beverage industry, so drink up America! Let that idea for a specialty drink come out and play. Drink Labs wants to team up and help you develop your beverage idea, so you can get a big gulp of this exciting industry.

Beverages are a huge category and growing each and every day. This is a very interesting trend and it's only getting bigger and more popular each year. Why? Health conscious generations are paying more and more attention to what they eat, drink and put into their bodies. They want health in a bottle, healthy alternatives that are easy, convenient and functional. That teamed with specialty coffee, craft teas, flavored waters, and some really cutting edge ingredients are on the market everywhere. We're seeing fermented kombucha(what's that? It's fermented tea rich in probiotics) and drinks that are infused with legal CBC....that's cannabis but without the high! They say it helps with chronic pain and some other painful medical issues. Oh, yes, some of the most popular beverages in today's world include ingredients that are replacing traditional sugar and fructose corn syrup like stevia a natural sweetener, fresh fruit, banana puree, grape seed extract, and good old-fashioned honey. Some honey even is infused with amazing essential oils like lavender, rosemary, and spearmint. There is also the growing nondairy trend that is ramping up nut milk like almond, coconut, and soy. There are even beverages made from flaxseed, hazelnuts, quinoa, macadamia nuts, and pecans. So much for eating healthy nuts, drinking their milk, as they call it, is all the rage.

This is where ingredient sourcing gets interesting. Have you seen the drinks that are full of collagen, the anti-aging ingredient that is associated with the beauty industry? And we don't want to forget the extremely popular energy drinks, fruit and vegetable juices, and sparkling water. Did we mention chocolate? That's a popular beverage flavor worth mentioning. The sky is the limit with combinations and flavors. The sky is the limit with what the Drink Labs experts can accomplish with you. Let's get to work.

One more very exciting reason to jump on the make your own beverage bandwagon right now is that retailers, both brick and mortar and online are investing their money and shelf space with smaller, unknown, specialty beverage brands to increase margins and strengthen shopper loyalty. You could be the next big beverage thing. Drink Labs will help you develop and design eye-catching packaging that is just as creative as the drink inside. Team with us for beverage brand, win, win.

You can truly trust us as a dedicated team player. We believe in quality, authenticity, and transparency. We stand by and are committed to researching and sourcing the purest ingredients and developing beverage brands that will be successful. We listen to our customers and work together to create something like no other. We also stand by our formulations. You can count on us.

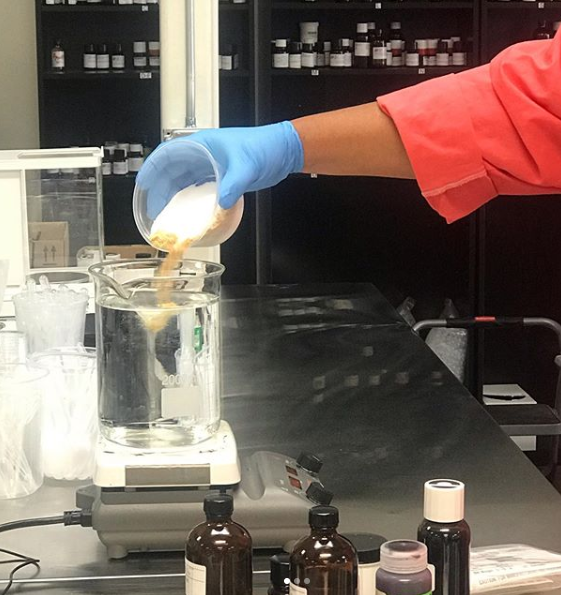

Our state-of-the-art in house lab is located in beautiful Southern California, close by some of the best ingredient vendors and packaging suppliers in the world. But don't worry, you don't have to be in California for us to help you be successful. We have clients in all areas of the country. Our teams can work remotely, connecting with you through teleconferencing like Skype or telephone at your convenience. We will even ship samples right to your door using major carriers like UPS or FedEx, anywhere in the world! We will make it happen.

Here is how it works. We are dedicated to your success. You own 100 percent of your beverage formulation and all of your brand assets. We have more than a combined 50 years of product development experience, state-of-the-art labs and in house technology that we put to work as part of your team and will assist you from idea to mass production. We take your direction, our expertise and make it happen. We'll discuss all of your beverage ideas asking the important questions and turn your idea over to our team of expert food scientists and chemists. We'll research and find all the ingredients from our hundreds of suppliers and go through what we a "flavor exploration." It's like a taste test. Then the fun begins. We will make recommendations, we'll have three rounds of formulation tweaks and the final result will be your dream beverage come true.

Next, we get really creative and start brainstorming sessions to start your very important brand identity. We'll walk you through packaging styles, graphics, colors, and fonts while keeping your beverages brand and target market in mind. You get to select everything with constructive input from our team. This includes everything from the bottle type, to the label to the cap

Here are a few categories of beverages the Drink Labs team can custom formulate for you. We can even combine more than one. It's totally up to you.

• Flavored Teas

• Flavored Waters

• Sodas

• Beers and Wines

• Energy Drinks

• Carbonated Drinks

• Fresh Juices

• Coffees

• Still Beverages

• Cold Pressed Juices

• Kombuchas

• Sports Drinks

Contact us today at sales@thedrinklabs.com and let's start creating your new beverage and your business today. Our team of chemists, beverage scientists, operations specialists, graphic artists and everyone in between are ready to make your beverage ideas a reality.

Report: Index Ranks U.S. Food Giants on Access to Nutrition

The 10 largest U.S. food and beverage companies need to step up efforts to improve the nutritional content and accessibility of their highest-selling products, according to the first-ever U.S. Access to Nutrition Index.

The Index, produced by the Access to Nutrition Foundation (ATNF), an independent non-profit organization based in the Netherlands, assigns a numerical score on a scale of one to 10 based on an evaluation of what the top ten food and beverage companies in the U.S. are doing to increase consumers’ access to healthy and affordable products.

The companies examined were The Coca-Cola Company, General Mills, The Kellogg Company, The Kraft Heinz Company, Mars, Unilever, Nestle and PepsiCo. Dr Pepper Snapple (DPS) was also included based on data from prior to its merger with Keurig Green Mountain in January. The companies were selected based on total U.S. sales of packaged food, hot drinks and soft drinks in 2016.

The ATNF, founded in 2013, has produced global indexes biennially that examine what the food and beverage industry is doing to address all forms of malnutrition, including obesity, undernutrition, food insecurity, micronutrient deficiency and diet-related diseases. The first-ever U.S. Index, published today, was funded by a grant from the Robert Wood Johnson Foundation.

The “Findings” section of the report read, “The U.S. Spotlight Index 2018 finds that overall America’s ten largest food and beverage manufacturers lack comprehensive strategies, policies and action to effectively address the national’s high levels of obesity and diet-related diseases.”

With a score of 5.3, Nestlé scored the highest on the Corporate Profile ranking, which summarizes companies’ performance in response to addressing obesity and diet-related diseases across seven categories: governance, products, affordability and accessibility, marketing, employee and consumer health and wellness, and labeling.

Unilever (4.7) and PepsiCo (4.4) finished second and third, respectively, while Kraft Heinz (0.8) and Dr Pepper Snapple (0.6) provided the two lowest scores. The average Corporate Profile score was 3 out of 10.

In the Product Profile ranking, which evaluates the healthiness of a company’s product portfolio, ConAgra led with a score of a 5.8 out of 10, followed by Kraft Heinz (5.6) and General Mills (5.2). Dr Pepper Snapple (3.4) and Mars (1.6) had the two lowest scores. Only 30 percent of the products assessed are healthy, according to the criteria used.

In laying the context for the rankings, the report cites the U.S. obesity rate — 40 percent for adults and 18.5 percent for children — as a threat to the country’s health care system and economy. While acknowledging the obesity crisis as having “complex” causes, it notes that the “nutritional quality of foods and beverages offered by America’s major manufacturers and how these products are labeled, marketed, priced and distributed contribute to the obesity epidemic.”

In conclusion, the Index recommends that the 10 companies included in its analysis take greater steps to improve the nutritional quality of their offerings and make them more accessible to populations that may be limited by income or geographic factors. It also calls for those companies to establish specific goals for improvement in a litany of areas, including product innovation, reformulation, marketing, employee health and wellness, labeling, lobbying and stakeholder engagement.

Speaking with BevNET from the Netherlands, ATNF Executive Director Inge Kauer said that the concept for the inaugural U.S. Index is to provide the companies involved with a benchmark for success and to establish sets of best practices that can be integrated into corporate policy.

“We believe companies can play a major role in tackling the nutrition challenges by providing healthier products and marketing and labeling, and distributing them in a more impactful and responsible way,” she said.

In discussing the rankings, Kauer said that progress made by companies in certain areas should be commended, despite the fact that the low average scores underlined the need for further action. She applauded efforts by Nestlé to be transparent about its nutrition strategy and its relationship to the overall business, as well as the work Unilever and ConAgra have done to disclose progress against reformulation targets aimed at making healthier products.

“We are proud that ATNI recognized our steady progress to meet our nutrition commitments, to transparently communicate with consumers and to support the wellness of our employees,” said Wendy Johnson, PhD, MPH, RD, Vice President of Nutrition Health and Wellness for Nestlé, in a press release. “As a business, our growth strategy is driven by a deep focus on how consumers are evolving, which makes our focus on nutrition and wellness ever more relevant. We will conduct a full review of ATNI’s assessment of our U.S. practices to determine areas where we can further evolve and strengthen our approach.”

However, progress in other areas, such as accessibility and affordability, have been stagnant. The 10 companies in the Index scored an average of 0.6 out of 10 in accessibility and affordability, compared to 2.5 for the global index, and Kauer said none of them have a formal policy with specific targets for lowering the difference between its existing healthier, more expensive products and its less expensive, less healthy lines. Contributions to food assistance programs were also weak, with only Kellogg and PepsiCo making commitments to donate a high percentage of their respective healthy products to food banks.

The report also recommended that companies commission independent audits of its compliance with its commitments to marketing to children and reduce amount of marketing around schools and other locations popular with children, such as after school programs. Only General Mills and Kraft Heinz have committed not to market in K-12 schools, and only Mars has commissioned a third-party audit of its marketing practices.

Kauer called the development of the Index an “interactive process between companies, investors, policymakers and societal organizations.” Information was initially gathered through an online data-gathering platform, for which companies were provided with the details and training on its use. Companies were offered the opportunity to comment on ATNF’s assessment of the data and respond to questions. After ATNF evaluated those responses, the group returned to the companies for further clarification and response to follow up questions. All companies, with the exception of ConAgra, Dr Pepper Snapple and Kraft Heinz, engaged with ATNF at that stage.

Going forward, Kauer said she hopes more companies actively engage with ATNF in the making of the Index, and that independent organizations like the Partnership for Healthier America and the Alliance for Healthy Generations use its data in their work.

The Index also serves as an independent, publicly available analysis that investors can use to guide their decision making. ATNF has more than 50 investor signatories, Kauer said, who use the scorecards the organization produces that analyze companies’ strengths and deficiencies.

All the companies involved have been invited to participate in a meeting on Friday, Kauer said, to further discuss the Index and how its recommendations can be implemented.

“It’s the starting point for a dialogue of how we can accelerate change,” Kauer said. “For many of these companies that is really the starting point for change, as we have seen happen globally.”

-Article comes care of BevNet

LaCroix is facing a lawsuit over the mysterious ingredient that has made it a huge hit — here's what we know about it

LaCroix's ingredients have sparked questions. Facebook/La Croix

• LaCroix is facing a lawsuit arguing that the sparkling-beverage brand contains artificial ingredients, a claim LaCroix categorically denies.

• LaCroix's use of "natural essences" has sparked questions and confusion for years.

• The essences are said to be concentrated natural chemicals that are safe to drink.

For years, LaCroix lovers have been faced with a mystery: What are natural essences?

The sparkling-water brand advertises that the essences are key to flavoring the zero-calorie drink, with "naturally essenced" appearing on most cans of LaCroix. But with the brand claiming the drink contains no calories or artificial flavors, understanding what the phrase actually means can be confusing.

A new class-action lawsuit filed against the brand's parent company, Natural Beverages, claims that LaCroix's all-natural claims are false and that these natural ingredients are actually synthetic.

"In fact, as the filing states, testing reveals that LaCroix contains a number of artificial ingredients, including linalool, which is used in cockroach insecticide," the law firm Beaumont Costales said in a statement. Natural Beverages said in a statement that it "categorically denies all allegations."

"All essences contained in LaCroix are certified by our suppliers to be 100% natural," the statement continued.

Beaumont Costales' argument essentially rests on the fact that these ingredients — which can be derived naturally — are also listed by the Food and Drug Administration as synthetic and can be used for some unappetizing purposes, like insecticides. Popular Science breaks down why the argument doesn't seem to hold up, noting that none of the ingredients mentioned in the case are considered dangerous.

"Whether a substance is 'natural' or 'synthetic' should not be a health issue," Roger Clemens, an expert in food and regulatory science at the University of Southern California, told Popular Science. "It's all about safety as assessed by experts in nutrition, food science, food toxicology, and medicine."

So, if LaCroix probably doesn't have any dangerous ingredients, what are natural essences anyway?

The Wall Street Journal dug into the phenomenon of these flavors last year.

"Essence is actually a clear, concentrated natural chemical that's been used for decades in products as varied as gravy, ice pops, coffee, shampoo and even insecticide, according to industry executives and scientists," The Journal reported.

Essence is created by heating items such as fruit and vegetable skins, rinds, and remnants at high temperatures, producing vapors. These vapors are condensed and then sold by the barrel.

LaCroix still hasn't clarified whether The Journal is right and what exactly these essences are. All its website has to say is: "The flavors are derived from the natural essence oils extracted from the named fruit used in each of our LaCroix flavors. There are no sugars or artificial ingredients contained in, nor added to, these extracted flavors."

-courtesy of Business Insider

Keurig Dr Pepper to Acquire CORE for $525 million.

One of a growing set of insurgent premium water brands was taken off the table this morning when Keurig Dr Pepper (KDP) announced that it had agreed to buy CORE Nutrition, the maker of CORE Hydration and CORE Organics, for $525 million.

Wholesale sales for CORE were between $70 and $80 million, according to a source close to the deal; retail sales were close to $200 million according to the brand. According to the announcement, KDP expects to realize $90 million in tax benefits in the deal.

“KDP has been an outstanding partner for CORE and I am certain that, under its ownership, CORE will continue to see tremendous long-term success,” said founder Lance Collins in a press release. “I am a strong supporter of the KDP strategy and business model and am looking forward to being a shareholder in the company.”

Core was founded in 2015 by Collins, a serial beverage entrepreneur known for starting brands like Fuze and Body Armor, in partnership with music producer Lukasz Gottwald, also known as Dr Luke. Other investors included celebrities like Katy Perry, Juicy J. and Diplo, as well as a variety of Hollywood executives. One company that benefited from the sale, albeit indirectly, was KDP rival Coca-Cola Co., which owned a stake in Core via incubator L.A. Libations. An early investor and distributor of Core, L.A. Libations is partially owned by Coke. Retailer 7-Eleven was also an investor, along with food and beverage entrepreneur Jason Cohen.

Last year, the company raised nearly $40 million.

The deal comes amid a reshuffling of the allied, independent brands distributed by Dr Pepper Snapple Group, which was taken over by Keurig earlier this year. Pressure increased on KDP to buy Core when Fiji, another premium water company in the allied brand portfolio, cut ties with KDP from a distribution standpoint. Another allied brand, Body Armor, is also leaving the fold, having agreed to a minority investment from the Coca-Cola Co. in August. The company purchased Bai in 2016 and owns a stake in High Brew coffee as well. Vita Coco remains independent but is widely distributed by KDP.

The transaction leaves independent water brand Essentia Water as an increasingly likely takeover target.

-Article courtesy of BevNet