Contact Us

JACKSON

511 E Pearl St.

Jackson, MS 39201

P: 601-355-0654

F: 601-510-9667

HATTIESBURG

607 Corinne St, Suite B-6

Hattiesburg, MS 39401

P: 601-475-1234

F: 601-510-9667

GULFPORT

2501 14th Street, Suite 211

Gulfport, MS 39501

P: 228-241-1612

F: 601-510-9667

Litigation

Gadow | Tyler provides a team of skilled litigators who can quickly evaluate a case and develop a clear, effective strategy to provide our clients with the most efficient path to recovery. As a boutique firm, Gadow | Tyler carefully evaluates and selects each case, and is thereby able to provide each client with more time and personal attention. Our attorneys will review and evaluate your case at no charge.

Personal Injury

Insurance Claims

Consumer Litigation

Products Liability

Property Damage

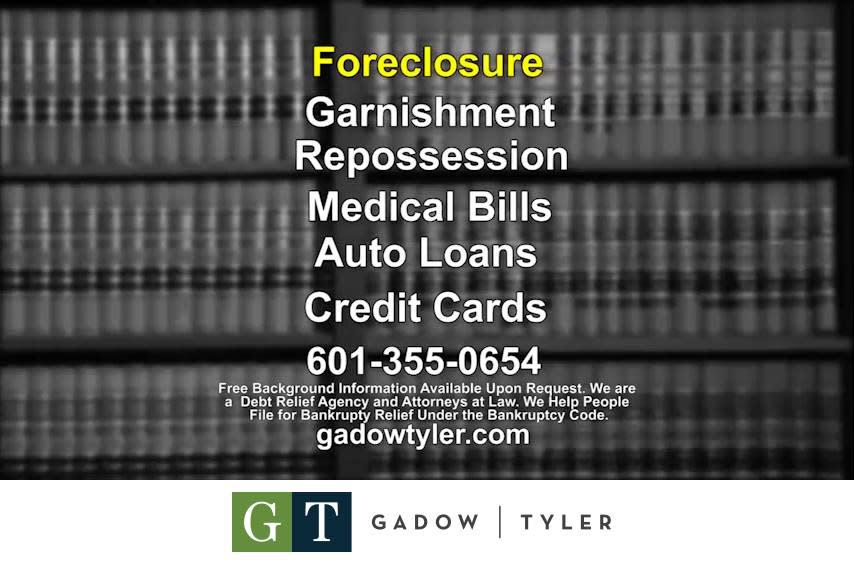

Comprehensive Consumer Bankruptcy Services

With over 40 years’ experience representing debtors in bankruptcy proceedings, Gadow | Tyler attorneys have the knowledge and experience to assist you in navigating your options when faced with overwhelming debt. We can assist you with the elimination or reorganization of your debt, and prevent home foreclosures, car repossessions and wage garnishments.

Chapter 11 and 13

Consumer bankruptcy

Mortgage refinances

Debt relief

Filing for bankruptcy

Small business formations

Social Security and Disability

Persons suffering from a physical disability or mental health disorder that limits their ability to work full-time may qualify for Social Security Disability (SSD) benefits. The law governing SSD can be challenging, and persons not accustomed to the legal terms and jargon found on the mandatory forms will typically require legal assistance in preparing their SSD paperwork. Gadow | Tyler attorneys can assist and advise you in navigating the confusing and time consuming process of seeking SSD.

Social Security and Disability

Persons suffering from a physical disability or mental health disorder that limits their ability to work full-time may qualify for Social Security Disability (SSD) benefits. The law governing SSD can be challenging, and persons not accustomed to the legal terms and jargon found on the mandatory forms will typically require legal assistance in preparing their SSD paperwork. Gadow | Tyler attorneys can assist and advise you in navigating the confusing and time consuming process of seeking SSD.

Worker's Compensation

Persons injured at work may be entitled to compensation from a state-governed insurance program known as worker’s compensation. Gadow | Tyler attorneys can help you navigate the compensation process, which can include medical evaluations from employer-provided and independent physicians, whose findings will largely determine the amount of compensation you are paid. Our attorneys will provide a careful explanation of the process, and skilled advocacy on your behalf.

Unfortunately, bad things happen to responsible people more often than anyone would like to admit. Whether you’re facing financial troubles because of a job loss or a medical emergency, we’re always here to help you reclaim control over your finances.

We recognize that many people aren’t simply looking for a way to walk away from their debts. When you have a steady income, it may be possible to use bankruptcy proceedings to renegotiate your payments so that you can pay back a portion of your debt at more affordable levels.

While bankruptcy can be a wonderful fresh start for families who’ve been hit hard by unexpected financial situations, it’s not without consequences. If you aren’t sure how filing for bankruptcy will impact your credit, we’re always here to help you gain a better understanding.

Unfortunately, a failed business venture can sometimes leave your personal finances in shambles. If you’re still trying to work miracles to pay off the debts of a sole-proprietorship you were forced to close, bankruptcy could be an appropriate option.

We recognize that many people aren’t simply looking for a way to walk away from their debts. When you have a steady income, it may be possible to use bankruptcy proceedings to renegotiate your payments so that you can pay back a portion of your debt at more affordable levels.

It’s important to remember that being unable to meet all your financial obligations doesn’t make you a bad person or lazy. Sometimes, life circumstances can put us into circumstances where there just isn’t enough money to pay all the bills.

In a chapter 13 bankruptcy filing, you can keep all of your property if your bankruptcy plan meets the requirements of the law. However, you will need to continue making payments despite your bankruptcy status.

If you can afford to continue making payments on your liens and mortgages, a chapter 13 bankruptcy may be your best option. One of the advantages of a chapter 13 plan is that you’re able to keep property such as your home.

If you are married, you can file for bankruptcy without your spouse, but understand that your spouse will still be liable for any joint debts. On the other hand, if you file together you’ll be able to double your exemptions. Speak to an attorney to determine the best course for you.

We recognize that filing bankruptcy is usually a choice of last resort for Americans struggling to keep up with their debt payments to creditors. When you’re ready to learn more about how bankruptcy could help you get your head back above water, we’re always here for you.

Lien stripping is a bankruptcy technique that allows a chapter 13 filer to transform a secured second mortgage or home equity line of credit into unsecured debt. Talk to an attorney to see if this might be a good option for you.

Keep in mind that there are some debts that bankruptcy will not erase. This includes child support and alimony, fines, some taxes, falsely acquired debts, student loans, and debts not listed on your bankruptcy petition.

We can explain the connection between Social Security disability insurance and automatic eligibility for Medicare. For the most part, if you have been receiving disability payments for two years you qualify for Medicare, no matter your age.

While it is true that some disabilities automatically qualify the individual for benefits, it does not mean that payments begin tomorrow. There is still an evaluation process, and other criteria that must be met. We can help expedite the process.

You may be a candidate for a chapter 7 bankruptcy if you have a large amount of unsecured debt (i.e. credit card debt or medical expenses) that you are no longer able to pay. A chapter 7 filing allows you to seek protection from creditors.

If you and your spouse are considering both bankruptcy and a divorce, we can explain your options. Often, it is a better idea to handle the bankruptcy before the divorce, but every situation is unique and must be assessed separately.

Bankruptcy cases can be quite complicated. A bankruptcy attorney is familiar with all the forms and paperwork required and also has a working relationship with the bankruptcy trustee and judge, which can be very helpful.

Bankruptcy can be a way to avoid foreclosure of your home or repossession of your car. A Chapter 13 filing immediately stops all collection activity. You can then propose a repayment plan to take care of any delinquent amounts owed.

It is not a good idea to handle a bankruptcy without an attorney. Given the complexity of bankruptcy laws, the various requirements and deadlines that must be met, a misstep can be devastating, resulting in the case being dismissed or not all of the debts being discharged.

Bankruptcy attorneys are lawyers who specialize in Bankruptcy law. Skilled in this field, they work with those individuals who believe that declaring bankruptcy is in their best interests. It is a bankruptcy attorney’s responsibility to make sure that everything proceeds smoothly and in compliance with bankruptcy laws.

Bankruptcy laws have changed and evolved in recent years, and unless you are well-versed in these changes, you may be in over your head if you decide to represent yourself. Seek the advice and guidance of an attorney.

If you are facing foreclosure, filing for bankruptcy can stop the process and help you keep your home. However, there are deadlines and a specific timeframe that must be adhered to so that you do not jeopardize your residence. Talk with a qualified bankruptcy attorney for proper guidance.