Search Homes Like an Agent. Click on Photo or Link

⬇️⬇️⬇️

https://mynewazhome.com

MYNEWAZHOME.COM

Jonel Kern - Realty One Group

😂😅😅

Fun events for October! 👻🎃

100%!!! 😄👻🏠

Why Pricing Your Home Right Matters This Fall

As a seller today, you may think pricing your home on the high end will result in a higher final sale price, but the opposite is actually true.

To sell your home quickly and for the best possible price, you should eliminate buyer concerns by pricing your home competitively right from the start.

Let's connect today to make sure you have the guidance you need to price your home right this fall.

-KCM

#AZProperties #RealEstateGoals

#AZForSaleHomes #RealtorTrends #SellingAZ

For real!!! 😅

The 2020 Homebuyer Wish List

The word home is taking on a whole new meaning this year, and buyers are starting to look for new features as they re-think their needs and what's truly possible.

From more outdoor space to virtual classrooms for their children, buyers have a growing list of what they'd like to see in their homes.

Let's connect today if your needs have changed and your wish list is expanding too.

-KCM

#AZProperties #BuyingAZ #RealEstateGoals

#RealEstateBoss #RealtorTrends #HomeBuyingTips

That's what you call a real knee knocker 😅🏠

Americans Rank Real Estate Best Investment for 7 Years Running

Real estate has outranked stocks, savings accounts, and gold as the best long-term investment among Americans for the past 7 years.

The belief in the stability of housing as a long-term investment remains strong, despite the many challenges our economy faces today.

Of the four listed, real estate is also the only investment you can also live in. That's a big win!

-KCM

#AZProperties #RealEstateGoals

#I'veGotYouCovered

#ILoveRealEstate #RealtorTrends

Congratulations to the Johnson family!!! Just sold their house and helped them purchase their new home in Wittman!! 😀🏡

Sounds good to me!

Does Your Home Have What Buyers Are Looking For?

There's great opportunity for today's homeowners to sell their houses and make a move, yet due to the impact of the ongoing health crisis, some sellers are taking their time coming back to the market. According to Javier Vivas, Director of Economic Research at realtor.com:

Sellers continue returning to the market at a cautious pace and further improvement could be constrained by lingering coronavirus concerns, economic uncertainty, and civil unrest.

For homeowners who need a little nudge of motivation to get back in the game, it's good to know that buyers are ready to purchase this season. After spending several months at home and re-evaluating what they truly want and need in their space, buyers are ready and they're in the market now. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR) explains:

A number of potential buyers noted stalled plans due to the pandemic and that has led to more urgency and a pent-up demand to buy…After being home for months on end – in a home they already wanted to leave – buyers are reminded how much their current home may lack certain desired features or amenities.

The latest Market Recovery Survey from NAR shares some of the features and amenities buyers are looking for, especially since the health crisis has shifted many buyer priorities. The most common home features cited as increasingly important are home offices and space to accommodate family members new to the residence. See attached graph.

The survey results also show that among buyers who indicate they would now like to live in a different area due to COVID-19, 47% have an interest in purchasing in the suburbs, 39% cite rural areas, and 25% indicate a desire to be in small towns.

As we can see, buyers are eager to find a new home, but there's a big challenge in the market: a lack of homes available to purchase. Danielle Hale, Chief Economist at realtor.com explains:

The realtor.com June Housing Trends Report showed that buyers still outnumber sellers which is causing the gap in time on market to shrink, prices to grow at a faster pace than pre-COVID, and the number of homes available for sale to decrease by more than last month. These trends play out similarly in the most recent week's data with the change in time on market being most notable. In the most recent week homes sat on the market just 7 days longer than last year whereas the rest of June saw homes sit 2 weeks or more longer than last year.

In essence, home sales are picking up speed and buyers are purchasing them at a faster rate than they're coming to the market. Hale continues to say:

The housing market has plenty of buyers who would benefit from a few more sellers. If the virus can be contained and home prices continue to grow, this may help bring sellers back to the housing market.

Bottom Line

If you're considering selling and your current house has some of the features today's buyers are looking for, let’s connect. You'll likely be able to sell at the best price, in the least amount of time, and will be able to take advantage of the low interest rates available right now when buying your new home.

-KCM

#AZProperties #RealEstateGoals

#I'veGotYouCovered

#ILoveRealEstate #RealtorTrends

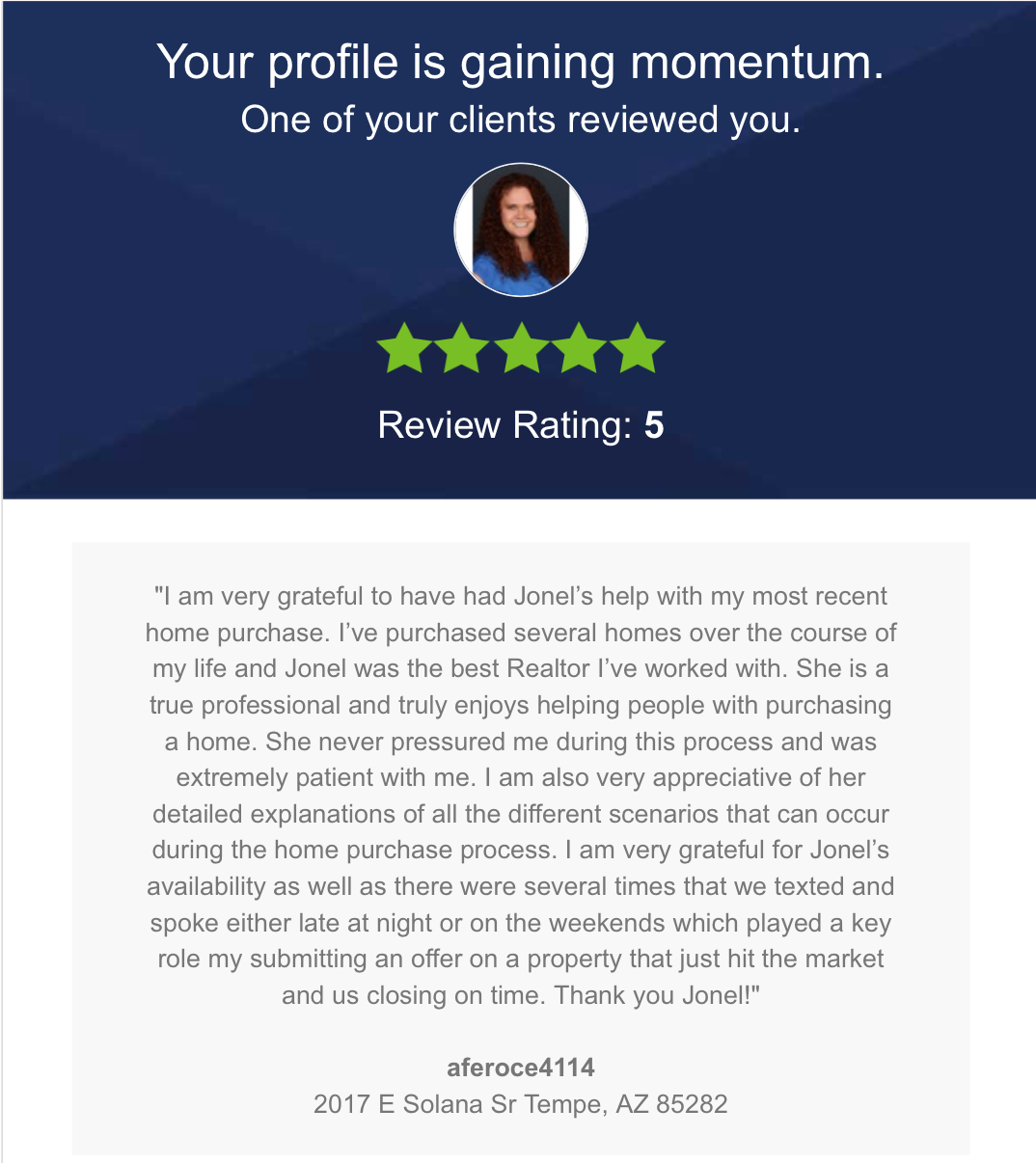

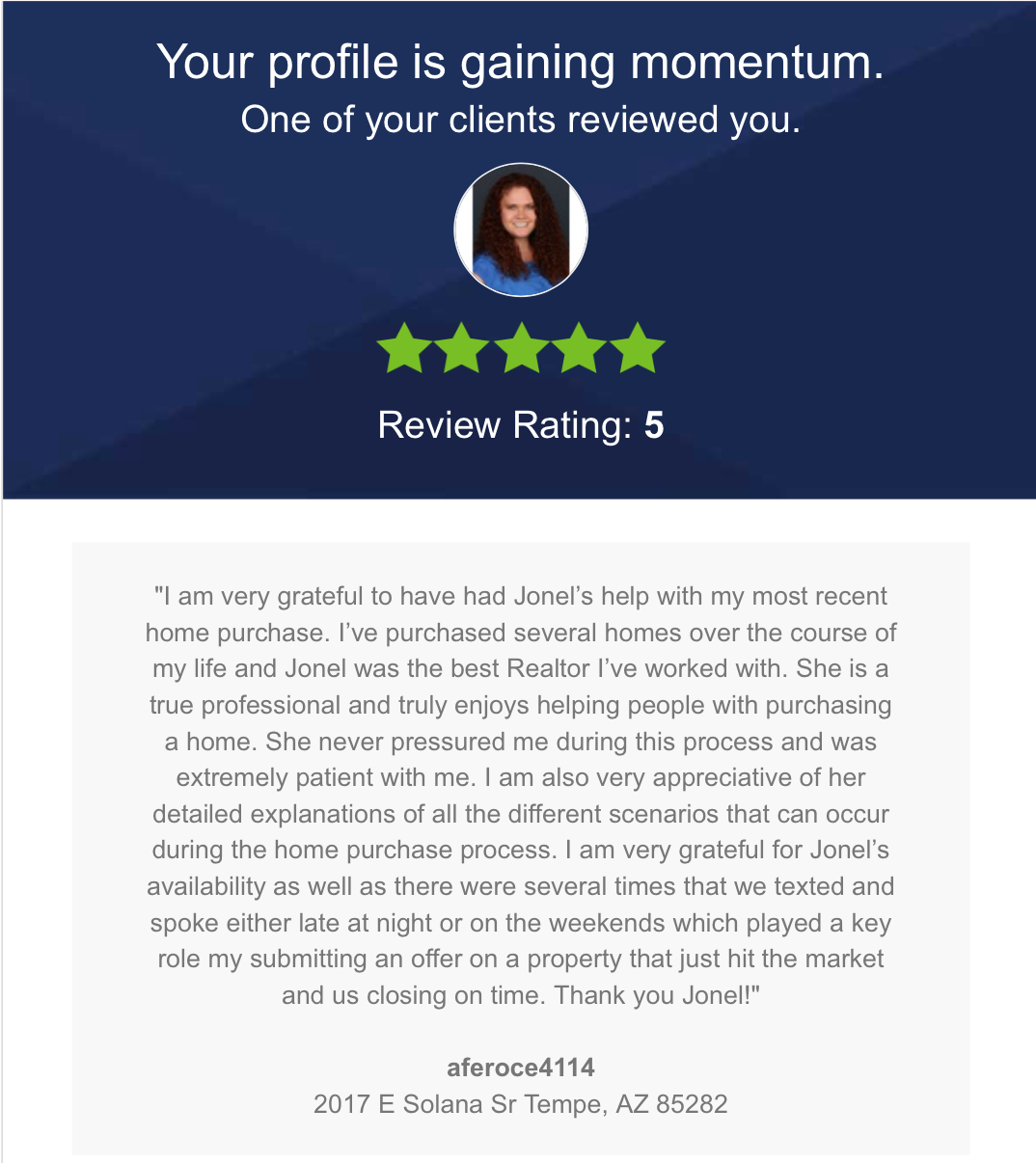

😊

Buying or Selling a Home? You Need an Expert Kind of Guide

In a normal housing market, whether you're buying or selling a home, you need an experienced guide to help you navigate through the process. You need someone you can turn to who will tell you how to price your home correctly right from the start. You need someone who can help you determine what to offer on your dream home without paying too much or offending the seller with a low-ball offer.

We are, however, in anything but a normal market right now. We are amid one of the greatest health crises our nation has ever seen. The pandemic has had a dramatic impact on the journey consumers take to purchase or sell a home. To successfully navigate the landscape today, you need more than an experienced guide. You need a ‘Real Estate Sherpa.'

According to Lexico, a Sherpa is a member of a Himalayan people living on the borders of Nepal and Tibet, renowned for their skill in mountaineering. Sherpas are skilled in leading their parties through the extreme altitudes of the peaks and passes in the region – some of the most treacherous trails in the world. They take pride in their hardiness, expertise, and experience at very high altitudes.

They are much more than just guides.

This is much more than a normal real estate market.

Today, the average guide just won't do. You need a Sherpa. You need an expert who understands how COVID-19 is impacting the thoughts and actions of the consumer (ex: virtual showings, proper safety protocols, e-signing documents). You need someone who can simply and effectively explain the changes in today's process to you and your family. You need an expert who will guarantee you make the right decision, especially in these challenging times.

Bottom Line

Hiring an agent who understands how the pandemic is reshaping the real estate processes is crucial right now. Let's connect today to guarantee your journey is a safe and successful one.

-KCM

#covid19 #coronavirus #AZProperties #RealEstateGoals

#AZForSaleHomes #RealtorTrends #SellingAZ

Open house today from 1-4! Come check out this gorgeous home and say hi! 😊🏡

Jonel Kern - My New AZ Home

November 14 at 9:39 AM ·

Open House tomorrow from 1-4 PM! Come check out this beautiful property in Dove Valley Ranch, Peoria, AZ!

Open House tomorrow from 1-4 PM! Come check out this beautiful property in Dove Valley Ranch, Peoria, AZ!

Think You Should For Sale By Owner? Think Again...

For Sale By Owner (FSBO) is the process of selling real estate without the representation of a real estate broker or real estate agent.

According to the National Association of Realtors' Profile of Home Buyers & Sellers, 35% of homeowners who decided to FSBO last year did so to avoid paying a commission or fee. But, homes sold with an agent net 6% more than those sold as a FSBO according to Collateral Analytics.

Before you decide to take on the challenge of selling your house on your own, let's connect to discuss your options.

-KCM

#AZProperties #RealEstateGoals

#AZForSaleHomes #RealtorTrends #SellingAZ

#forsalebyowner

Why Today's Options Will Save Homeowners from Foreclosure

Many housing experts originally voiced concern that the mortgage forbearance program (which allows families impacted financially by COVID to delay mortgage payments to a later date) could lead to an increase in foreclosures when forbearances end.

Some originally forecasted that up to 30% of homeowners would choose to enter forbearance. Less than 10% actually did, and that percentage has been dropping steadily. Black Knight recently reported that the national forbearance rate has decreased to 5.6%, with active forbearances falling below 3 million for the first time since mid-April.

Many of those still in forbearance are actually making timely payments. Christopher Maloney of Bloomberg Wealth recently explained:

Almost one quarter of all homeowners who have demanded forbearance are still current on their mortgages…according to the latest MBA data.

However, since over two million homeowners are still in forbearance, some experts are concerned that this might lead to another wave of foreclosures like we saw a little over a decade ago during the Great Recession. Here is why this time is different.

There Will Be Very Few Strategic Defaults

During the housing crash twelve years ago, many homeowners owned a house that was worth less than the mortgage they had on that home (called negative equity or being underwater). Many decided they would just stop making their payments and walk away from the house, which then resulted in the bank foreclosing on the property. These foreclosures were known as strategic defaults. Today, the vast majority of homeowners have significant equity in their homes. This dramatically decreases the possibility of strategic defaults.

Aspen Grove Solutions, a business consulting firm, recently addressed the issue in a study titled Creating Positive Forbearance Outcomes:

Unlike in 2008, strategic defaults have not emerged as a serious problem and seems unlikely to emerge given stronger expectations for property price increases, a record low inventory of homes, and stable residential underwriting standards leading up to the crisis which has reduced the number of owners who are underwater.

There Are Other Options That Were Not Available the Last Time

A decade ago, there wasn't a forbearance option, and most banks did not put in other programs, like modifications and short sales, until very late in the crisis.

Today, homeowners have several options because banks understand the three fundamental differences in today's real estate market as compared to 2008:

1. Most homeowners have substantial equity in their homes.

2. The real estate market has a shortage of listings for sale. In 2008, homes for sale flooded the market.

3. Prices are appreciating. In 2008, prices were depreciating dramatically.

These differences allow banks to feel comfortable giving options to homeowners when exiting forbearance. Aspen Grove broke down some of these options in the study mentioned above:

Refinance Repay: Capitalize forbearance amount – For borrowers who have strong credit, have good or improved equity in their homes, possibly had a higher interest rate on their original loan, have steady employment/no significant wage loss, and income.

Repayment Plan: Pay it back in higher monthly payments – For people who cannot reinstate using savings, but have increased monthly income, and do not want to use a deferral program.

Deferral Program: Shift payments to the end of the loan term – For borrowers who lost income temporarily and regained most or all of their income but are not in a position to refinance due to credit score, home equity, low total loan value relative to closing costs, or simple apathy.

Modification Flex Modification: Or other mod – For households that permanently lost 20% to 30% of their income, but not all of their income, and want to remain in their home.

Each one of these programs enables the homeowner to remain in the home.

What about Those Who Don't Qualify for These Programs?

Homeowners who can't catch up on past payments and don't qualify for the programs mentioned have two options: sell the house or let it go to foreclosure. Some experts think most will be forced to take the foreclosure route. However, an examination of the data shows that probably won't be the case.

A decade ago, homeowners had very little equity in their homes. Therefore, selling was not an option unless they were willing to tap into limited savings to cover the cost of selling, like real estate commission, closing costs, and attorney fees. Without any other option, many just decided to stay in the house until they were served a foreclosure notice.

As mentioned above, today is different. Most homeowners now have a large amount of equity in their homes. They will most likely decide to sell their home and take that equity rather than wait for the bank to foreclose.

In a separate report, Black Knight highlighted this issue:

In total, an estimated 172K loans are in forbearance, have missed three or more payments under their plans and have less than 10% equity in their homes.

In other words, of the millions currently in a forbearance plan, there are few that likely will become a foreclosure.

Bottom Line

Some analysts are talking about future foreclosures reaching 500,000 to over 1 million. With the options today's homeowners have, that doesn't seem likely.

-KCM

#AZProperties #AZForSaleHomes #azrealestate #azrealestate #realestatetips

Should I Renovate My House Before I Sell It?

-In today's hyper-competitive market, buyers are often willing to overlook cosmetic or minor repair needs if it means snagging a home in their price range.

-With so few houses available for sale today, you may be able to skip the bigger renovations before you sell and cash in on the current demand for your house.

If you're ready to move, let's connect to determine your best next steps in this sellers' market.

-KCM

#AZProperties #RealEstateGoals

#I'veGotYouCovered

#ILoveRealEstate #SellingAZ

Fun stuff for December! 🌲

Americans Are Gaining Confidence in the Economy

The September Jobs Report issued by the Bureau of Labor Statistics reported that the unemployment rate dropped to 7.9%. Though that percentage is well below what experts projected earlier this year, it still means millions of people are without work. There's no way to minimize the tremendous impact this pandemic-induced recession continues to have on many Americans.

However, the latest Home Purchase Sentiment Index from Fannie Mae shows how more and more Americans believe the worst is behind us, and their personal employment situation is good. The index revealed:

The percentage of respondents who say they are not concerned about losing their job in the next 12 months increased from 78% to 83%, while the percentage who say they are concerned decreased from 22% to 16%. As a result, the net share of Americans who say they are not concerned about losing their job increased 11 percentage points.

Americans Are Game-Changers Too

Americans are naturally optimistic and have always responded to challenges with both resiliency and resourcefulness. Today is no different. As an example, the Wall Street Journal (WSJ) just reported:

Americans are starting new businesses at the fastest rate in more than a decade, according to government data, seizing on pent-up demand and new opportunities after the pandemic shut down and reshaped the economy.

Why would someone start a business in the middle of an economic crisis? The WSJ explains:

The jump may be one sign that the pandemic is speeding up ‘creative destruction,' the concept…to describe how new, innovative businesses often displace older, less-efficient ones, buoying long-term prosperity.

The WSJ also notes that these new businesses will have a positive impact on the overall employment situation, as new businesses are a critical engine of job creation. Startups have historically accounted for around one-fifth of job creation.

Bottom Line

For the millions of Americans still unemployed, we hope for a quick return to the workforce. We should, however, realize that over 90% of people are still employed, and some are venturing into new business start-ups. Perhaps the next big game-changing company is right around the corner.

-KCM

#AZProperties #AZForSaleHomes #azrealestate #azrealestate #realestatetips

Check out this beautiful home located in Peoria, AZ at Lake Pleasant & Deer Valley! This amazing home features 5 bedrooms, with the master and one other bedroom on the main level. 3038 sq ft listed at $449,900 with beautiful upgrades including granite, gas top range and tile backsplash. Contact me for more info! 🙂🏡

Home Values Projected to Keep Rising

As we enter the final months of 2020 and continue to work through the challenges this year has brought, some of us wonder what impact continued economic uncertainty could have on home prices. Looking at the big picture, the rules of supply and demand will give us the clearest idea of what is to come.

Due to the undersupply of homes on the market today, there's upward pressure on prices. Consider simple economics: when there is high demand for an item and a low supply of it, consumers are willing to pay more for that item. That's what's happening in today's real estate market. The housing supply shortage is also resulting in bidding wars, which will also drive price points higher in the home sale process.

There's no evidence that buyer demand will wane. As a result, experts project price appreciation will continue over the next twelve months. Here's a graph of the major forecasts released in the last 60 days.

I hear many foreclosures might be coming to the market soon. Won't that drive prices down?

Some are concerned that homeowners who entered a mortgage forbearance plan might face foreclosure once their plan ends. However, when you analyze the data on those in forbearance, it's clear the actual level of risk is quite low.

Ivy Zelman, CEO of Zelman & Associates and a highly-regarded expert in housing and housing-related industries, was very firm in a podcast last week:

The likelihood of us having a foreclosure crisis again is about zero percent.

With demand high, supply low, and little risk of a foreclosure crisis, home prices will continue to appreciate.

Bottom Line

Originally, many thought home prices would depreciate in 2020 due to the economic slowdown from the coronavirus. Instead, prices appreciated substantially. Over the next year, we will likely see home values rise even higher given the continued lack of inventory of homes for sale.

-KCM

#AZProperties #AZForSaleHomes #azrealestate #azrealestate #realestatetips

❤️🌲

If you could wish for anything under the Christmas tree this year, what would it be?

2021 Housing Forecast

-Experts project an optimistic year for the 2021 housing market.

-With mortgage rates forecasted to remain low, high buyer demand is expected to fuel more home sales and continue to increase home prices.

-Let's connect today to determine how to make your best move in the new year.

-KCM

#RealtorTrends #AZForSaleHomes #2021azrealestate #2021realestate #AZForSaleHomes #AZProperties

#BuyingAZ

Dog wash station in the laundry. Yay or nay! 🐶I'm going with yay!

Right?!!? 😅

When you want to decorate for Christmas but still need to sell your house. 😀🎄

❤️❤️

Who's with me? 😅

Cheers to 2021!

What do you think if this type of home architecture?

A little real A little real estate humor 😅

Beach house for me! You?

Sunglasses! 😂 You?

The look you have when your offer is the one that gets accepted out of multiple offers for your clients! 😀

Give me a caption for this bathroom "design". 😅

Joy! Your turn!

But really? 😀

#truth 😅

Mervyn's! What about you?

16! 😅I knew I was a little picky, but oh my! 😅 What about you?

Fun stuff for February! 🥰

Another successful closing! Helped my client sell his rental property and found just the right buyer that is allowed the renter stay! Talk

about win win! 🏡🎉

Seriously! 😅

😀

How to Prepare for a Bidding War

-With so few houses available on the market today, being ready for a bidding war is essential for prospective homebuyers.

-From pre-approval to making your best offer, here are three tips to make sure you can act quickly and confidently when you find the perfect home.

-Let's connect today to be sure you have the guidance you need as the competition for homes heats up this season.

-KCM

#RealtorTrends #AZForSaleHomes #2021azrealestate #2021realestate #AZForSaleHomes #AZProperties

#BuyingAZ

Selling Your House Is the Right Move, Right Now

-Demand from homebuyers has skyrocketed this year, which means today's sellers are poised to win big.

-This ideal moment in time to sell your house won't last forever, though.

-With more sellers coming to the market in the spring, waiting until next year means buyers will have more choices, so your home may not stand out from the crowd.

Let's connect today to discuss why now may be the right time to make a move on your terms.

-KCM

#RealtorTrends #AZForSaleHomes #2021azrealestate #2021realestate #AZForSaleHomes #AZProperties

#BuyingAZ

Turn to an Expert for the Best Advice, Not Perfect Advice

As we approach the anniversary of the hardships we've faced through this pandemic and the subsequent recession, it's normal to reflect on everything that's changed and wonder what's ahead for 2021. While there are signs of economic recovery as vaccines are being issued, we still have a long way to go. It's at times like these we want exact information about anything we're doing. That information brings knowledge, and this gives us a sense of relief and comfort in uncertain times.

If you're thinking about buying or selling a home today, the same need for information is very real. But, because it's such a big step in our lives, that desire for clear information is even greater in the homebuying or selling process. Given the current level of overall anxiety, we want that advice to be truly perfect. The challenge is, no one can give you perfect advice. Experts can, however, give you the best advice possible.

Let's say you need an attorney, so you seek out an expert in the type of law required for your case. When you go to her office, she won't immediately tell you how the case is going to end or how the judge or jury will rule. If she could, that would be perfect advice. What a good attorney can do, however, is discuss with you the most effective strategies you can take. She may recommend one or two approaches she believes will be best for your case.

She'll then leave you to make the decision on which option you want to pursue. Once you decide, she can help you put a plan together based on the facts at hand. She'll help you achieve the best possible resolution and make whatever modifications in the strategy are necessary to guarantee that outcome. That's an example of the best advice possible.

The role of a real estate professional is just like the role of a lawyer. An agent can't give you perfect advice because it's impossible to know exactly what's going to happen throughout the transaction – especially in this market.

An agent can, however, give you the best advice possible based on the information and situation at hand, guiding you through the process to help you make the necessary adjustments and best decisions along the way. An agent will lead you to the best offer available. That's exactly what you want and deserve.

Bottom Line

If you're thinking of buying or selling this year, let's connect to make sure you get the best advice possible.

-KCM

#RealtorTrends #AZForSaleHomes #2021azrealestate #2021realestate #AZForSaleHomes #AZProperties

#BuyingAZ

Sad but true! That's the market right now.

Want to Build Wealth? Buy a Home This Year.

Every year, households across the country make the decision to rent for another year or take the leap into homeownership. They look at their earnings and savings and then decide what makes the most financial sense. That equation will most likely take into consideration monthly housing costs, tax advantages, and other incremental expenses. Using these measurements, recent studies show that it's still more affordable to own than rent in most of the country.

There is, however, another financial advantage to owning a home that's often forgotten in the analysis – the wealth built through equity when you own a home.

Odeta Kushi, Deputy Chief Economist for First American, discusses this point in a recent blog post. She explains:

Once you include the equity benefit of price appreciation, owning made more financial sense than renting in 48 out of the 50 top markets, with the only exceptions being San Francisco and San Jose, Calif.

What has this equity piece meant to homeowners in the past?

ATTOM Data Solutions, the curator of one of the nation's premier property databases, just analyzed the typical home-price gain owners nationwide enjoyed when they sold their homes. See the attached breakdown of their findings.

The typical gain in the sale of the home (equity) has increased significantly over the last five years.

CoreLogic, another property data curator, also weighed in on the subject. According to their latest Homeowner Equity Insights Report, the average homeowner gained $17,000 in equity in just the last year alone.

What does the future look like for homeowners when it comes to equity?

Take a look at the seven major home price appreciation forecasts for 2021.

The National Association of Realtors (NAR) just reported that today, the median-priced home in the country sells for $309,800. If homes appreciate by 5% this year (the average of the forecasts), the homeowner will increase their wealth by $15,490 in 2021 through increased equity.

Bottom Line

As you make your plans for the coming year, be sure to consider the equity benefits of home price appreciation as you weigh the financial advantages of buying over renting. When you do, you may find this is the perfect time to jump into homeownership.

-KCM

#RealtorTrends #AZForSaleHomes #2021azrealestate #2021realestate #AZForSaleHomes #AZProperties

#BuyingAZ

Things to Avoid after Applying for a Mortgage

Some Highlights

-There are a few key things to make sure you avoid after applying for a mortgage to help make sure you still qualify for your loan at the closing table.

-Along the way, be sure to discuss any changes in income, assets, or credit with your lender, so you don't unintentionally jeopardize your application.

-The best plan is to fully disclose your intentions with your lender before you do anything financial in nature.

-KCM

#RealtorTrends #AZForSaleHomes #2021azrealestate #2021realestate #AZForSaleHomes #AZProperties

#BuyingAZ

😂

This is a great analogy!

Reasons to Hire a Real Estate Professional

Some Highlights

-Choosing the right real estate professional to work with is one of the most important decisions you can make in your homebuying or selling process.

-The right agent can explain current market conditions and break down exactly what they mean for you.

-If you're considering buying or selling a home this year, let's connect so you can work with someone who has the experience to answer all of your questions about pricing, contracts, negotiations, and more.

-KCM

#RealtorTrends #AZForSaleHomes #2021azrealestate #2021realestate #AZProperties

#SellingAZ

So true! Let me help! Call me or message me today!

😅

Let me do the work for you! Call or message me today!

But really 😃

Super excited to help Jeff & Christy purchase their new home! We looked for awhile..but we found just the right house for them to call home! Happy to have been able to help them along their journey. 😃🏠