Disaster areas are granted an extension to file tax year 2019 Federal and California tax returns

until December 15, 2020.

On August 24, the IRS granted relief to individuals and businesses in eight California counties:

Lake, Monterey, Napa, San Mateo, Santa Cruz, Solano, Sonoma, and Yolo.

Any counties added later to the disaster area will be granted the same extension of time to file.

This relief applies to various upcoming tax filing deadlines including:

Individual filers whose previous tax-filing extension was set to end October 15.

YOUTUBE.COM

Reminders for Extension Filers-Oct. 15

Low Income Taxpayer Clinics Help Taxpayers

Low Income Taxpayer Clinics (LITCs) are independent from the IRS. Some serve individuals whose income is below a certain level and who need to resolve a tax problem.

MT & ASSOCIATES TAX SERVICE. 202 Pajaro St, Salinas, CA 93901, (831) 758-0482

Consumer Alerts on Tax Scams

Note that the IRS will never:

Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. Generally, the IRS will first mail you a bill if you owe any taxes.

Threaten to immediately bring in local police or other law-enforcement groups to have you arrested for not paying.

Demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe.… See More

IRS announces tax relief for California wildfire victims

Individuals and households who reside or have a business in Butte, Lake, Monterey, Napa, San Mateo, Santa Cruz, Solano, Sonoma and Yolo counties qualify for tax relief. but taxpayers in localities added later to the disaster area will automatically receive the same filing and payment relief.

The declaration permits the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area. For instance, certain deadlines falling on or after August 14, 2020, and before December 15, 2020, are postponed to December 15, 2020. This includes individual and business tax filers that had a valid extension to file their 2019 returns.

The IRS automatically identifies taxpayers located in the covered disaster area and applies filing and payment relief. But affected taxpayers who reside or have a business located outside the covered disaster area should call the IRS disaster hotline at 866-562-5227 to request this tax relief

Schedule A (Form 1040)

Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

MT & ASSOCIATES TAX SERVICE. 202 Pajaro St, Salinas, CA 93901, (831) 758-0482

Get My Payment

MT & ASSOCIATES TAX SERVICE. 202 Pajaro St, Salinas, CA 93901, (831) 758-0482

YOUTUBE.COM

Get My Payment

About Schedule B (Form 1040)

Use Schedule B (Form 1040) if any of the following applies:

You had over $1,500 of taxable interest or ordinary dividends.

You received interest from a seller-financed mortgage and the buyer used the property as a personal residence.

You have accrued interest from a bond.

You are reporting original issue discount (OID) in an amount less than the amount shown on Form 1099-OID.

You are reducing your interest income on a bond by the amount of amortizable bond premium.

You are claiming the exclusion of interest from series EE or I U.S. savings bonds issued after 1989.

You received interest or ordinary dividends as a nominee.

You had a financial interest in, or signature authority over, a financial account in a foreign country or you received a distribution from, or were a grantor of, or transferor to, a foreign trust. Part III of the schedule has questions about foreign accounts and trusts.

MT & ASSOCIATES TAX SERVICE. 202 Pajaro St, Salinas, CA 93901, (831) 758-0482

Low Income Taxpayer Clinics Help Taxpayers

Low Income Taxpayer Clinics (LITCs) are independent from the IRS. Some serve individuals whose income is below a certain level and who need to resolve a tax problem.

MT & ASSOCIATES TAX SERVICE. 202 Pajaro St, Salinas, CA 93901, (831) 758-0482

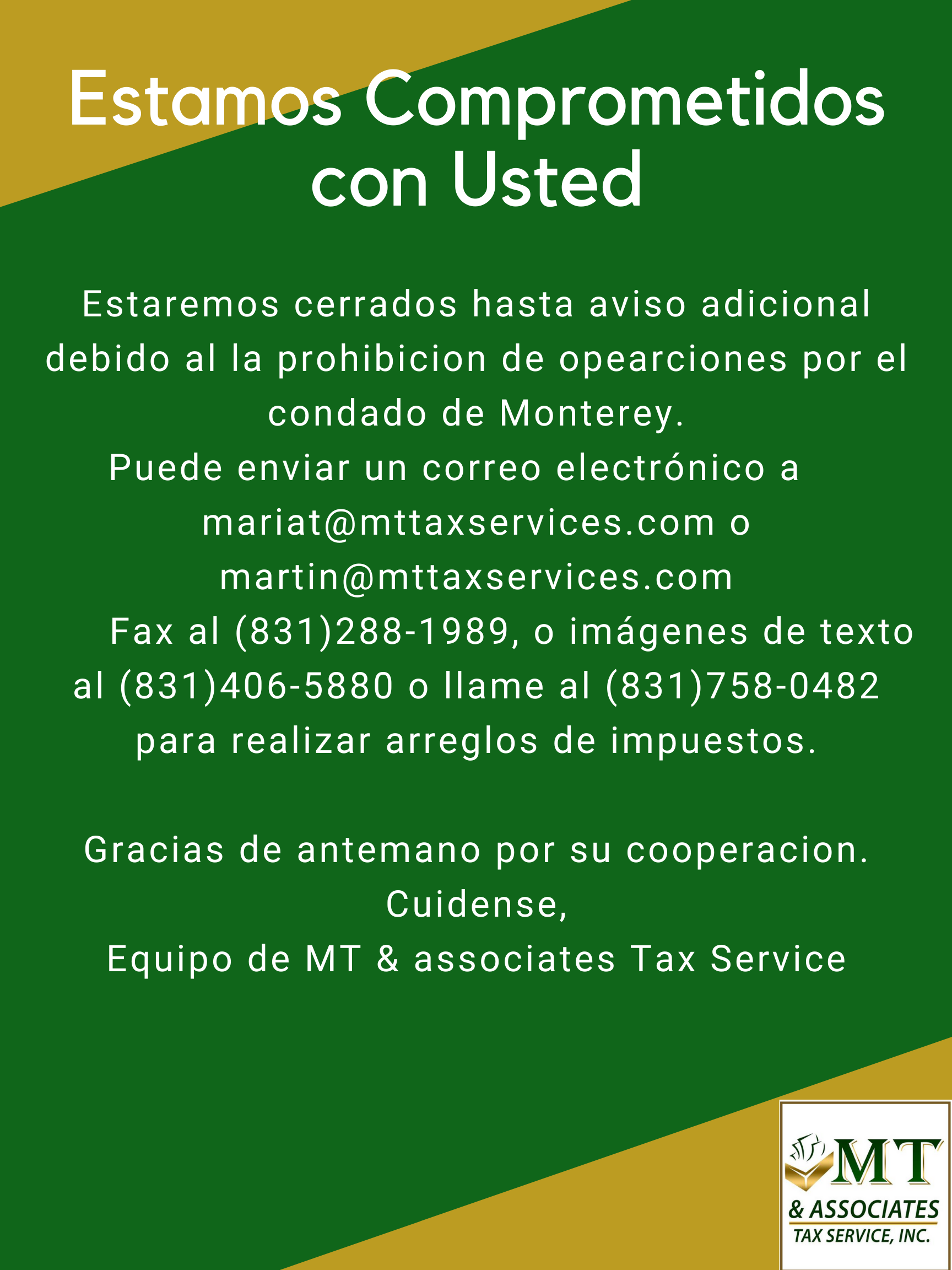

MT & Associates Tax Service, Inc. updated their business hours.

Renovación de Pasaporte

MT & ASSOCIATES TAX SERVICE Puede ayudarle 202 Pajaro St, Salinas, CA 93901, (831) 758-0482

Vote Sí a la proposición 22 si está en la industria del transporte y le gustaría permanecer como contratista independiente.

Vote No a la proposición 22 si desea ser reclasificado como empleado.

Vote Yes on prop 22 if you are in the transportation industry and would like to remain as an independent contractor.

Vote No on prop 22 if you would like to be reclassified into an employee.

Yes on Prop 22

November 2 at 9:30 AM ·

Prop 22 allows app-based drivers to be caretakers to loved ones, keep their side hustle, be available for their children, & have some financial relief. By a 4-to-1 margin, app-based drivers want to remain independent contractors. Support them and VOTE #YESonProp22

Tax Return Errors-Tips To Avoid Them

MT & ASSOCIATES TAX SERVICE. 202 Pajaro St, Salinas, CA 93901, (831) 758-0482

YOUTUBE.COM

Tax Return Errors-Tips To Avoid Them

Business Taxes:

The form of business you operate determines what taxes you must pay and how you pay them

MT & ASSOCIATES TAX SERVICE. 202 Pajaro St, Salinas, CA 93901, (831) 758-0482

MT & Associates Tax Service, Inc.

November 10, 2020 at 8:46 PM ·

About Schedule B (Form 1040)

Use Schedule B (Form 1040) if any of the following applies:

You had over $1,500 of taxable interest or ordinary dividends.

You received interest from a seller-financed mortgage and the buyer used the property as a personal residence.

You have accrued interest from a bond.

You are reporting original issue discount (OID) in an amount less than the amount shown on Form 1099-OID.

You are reducing your interest income on a bond by the amount of amortizable bond premium.

You are claiming the exclusion of interest from series EE or I U.S. savings bonds issued after 1989.

You received interest or ordinary dividends as a nominee.

You had a financial interest in, or signature authority over, a financial account in a foreign country or you received a distribution from, or were a grantor of, or transferor to, a foreign trust. Part III of the schedule has questions about foreign accounts and trusts.

MT & ASSOCIATES TAX SERVICE. 202 Pajaro St, Salinas, CA 93901, (831) 758-0482

🦃Happy Thanksgiving to all our Clients. 🦃 😊

202 Pajaro St Salinas, CA 93901

(831) 758-0482

About Schedule B (Form 1040)

Use Schedule B (Form 1040) if any of the following applies:

You had over $1,500 of taxable interest or ordinary dividends.

You received interest from a seller-financed mortgage and the buyer used the property as a personal residence.

You have accrued interest from a bond.

You are reporting original issue discount (OID) in an amount less than the amount shown on Form 1099-OID.

You are reducing your interest income on a bond by the amount of amortizable bond premium.

You are claiming the exclusion of interest from series EE or I U.S. savings bonds issued after 1989.

You received interest or ordinary dividends as a nominee.

You had a financial interest in, or signature authority over, a financial account in a foreign country or you received a distribution from, or were a grantor of, or transferor to, a foreign trust. Part III of the schedule has questions about foreign accounts and trusts.

MT & ASSOCIATES TAX SERVICE. 202 Pajaro St, Salinas, CA 93901, (831) 758-0482

About Schedule B (Form 1040)

Use Schedule B (Form 1040) if any of the following applies:

You had over $1,500 of taxable interest or ordinary dividends.

You received interest from a seller-financed mortgage and the buyer used the property as a personal residence.

You have accrued interest from a bond.

You are reporting original issue discount (OID) in an amount less than the amount shown on Form 1099-OID.

You are reducing your interest income on a bond by the amount of amortizable bond premium.

You are claiming the exclusion of interest from series EE or I U.S. savings bonds issued after 1989.

You received interest or ordinary dividends as a nominee.

You had a financial interest in, or signature authority over, a financial account in a foreign country or you received a distribution from, or were a grantor of, or transferor to, a foreign trust. Part III of the schedule has questions about foreign accounts and trusts.

MT & ASSOCIATES TAX SERVICE. 202 Pajaro St, Salinas, CA 93901, (831) 758-0482