John The Mortgage Man

(on holly)Mortgages and Mortgage Brokers in Corpus Christi, TX

VA Loans Conventional Loans FHA Loans Refinance

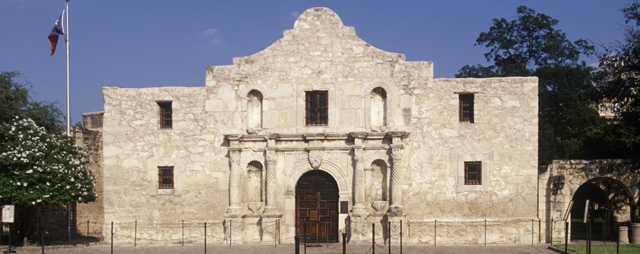

I’m John the Mortgage Man and as a Mortgage Coach I can help you learn the rules of the home loan game. My focus is to take the mystery out of the home loan process and use my 22 years of experience to make sure get the best home loan for your unique needs. If you are looking to purchase a home in Corpus Christi, San Antonio, Austin or anywhere else in the Texas you’ve come to the right place.

I have access to great loan programs that can make this process quick and easy. With conventional loans you will have access to a great combination of terms and low interest rates, that will allow you to own your dream home quicker and for less money. I also have access to the best government loans including FHA Loans and VA Loans. You can use an FHA loan to purchase your home with as low as a 3.5% down payment. If you are serving or have served in the military a VA loan which offers great rates and no down payment might be your best option.

When starting the home purchase process, you want to make sure that you get pre-approved or pre-qualified so that you're taken seriously by sellers. As your Mortgage Coach I work with you to improve your credit, explain all of the programs available to you, and help you get funding! In addition, I will show you how to save $53,727 on your home loan!

If you already own a home and think about a refinance, I can also help you save money on your existing mortgage. Home loan rates are currently very low, which means you could potentially save thousands of dollars a year by reducing your monthly mortgage payment. If you’ve tired to refinance but were denied due to being underwater with your home loan, I do have access to the HARP 2.0 refinance program which was created specifically to help homeowners get out of bad mortgages and lower your mortgage payments.

In 1991 I started originating loans. Through continuing education I have achieved certification as an FHA Specialist, VA Loan Advisor and Ethical Practices. My focus goes beyond helping clients "get a loan." I am their mortgage coach to help them win the mortgage game. Winning the game is more than closing on the loan; but how to manage your home loan in order to save thousands of dollars. I am available to answer questions after they move into their home and stay in contact with my clients to give information on how to save and manage money.

Over the past 22 years so much has changed in the mortgage industry. One major sift has been in how lenders view your credit. For over ten years, and before it was popular, I have helped clients understand the importance of credit and given them strategies on how to improve their credit and be able to get a better loan. Today it is imperative you understand credit and how to manage it in a way that strengthens your score. For this reason, I educate consumers on the "rules" of getting a home loan and the use of credit. This helps them to be prepared when they start the process of buying a home.

I am often asked about the name John The Mortgage Man. The truth is I did not come up with the name. I had only been in the mortgage business a couple of years and had a very unique loan. The clients had tried banks and other mortgage brokers but could not get a loan. Because of my background in creative financing they were able to close on their home. After the closing the realtor said, John you are the mortgage man. It stuck! Now, 20 years later, I still enjoy helping families finance a home; showing them how to retire debt and helping them build financial stability.